Market Commentary, 5 April 2020

Commentary

5 April 2020

“You’re riding high in April, shot down in May…”

That’s Life — Frank Sinatra

While I like Frank Sinatra a lot, I hope his song does not foretell future stock market performance!

Unfortunately, the data looks very grim. This past Thursday the weekly jobless claims came in at a whopping 6.65 million the most ever recorded. In the past two weeks there have been approximately 10 million Americans file for unemployment benefits. Monthly numbers showed a loss of 701,000 in March and unemployment rose to 4.4% from a near historic low of 3.5%. This is the largest monthly increase in unemployment since 1975!

The March service sector purchasing manager’s index saw the steepest decline in business activity since data collection began more than 10 years ago according to IHS Markit. Bank of America also slashed its GDP global forecasts for 2020 and now forecasts the US to decline 5.20% for the year.

It is also notable that many of the workers being let go are filing for the first time in their lives and are having trouble doing so; phone lines to unemployment offices are jammed and web sites are breaking down from too many people trying to access them. As a result, the March numbers are most likely less than what is actually happening and do not reflect the true state of the situation.

Moreover, the President of the St. Louis Federal Reserve expects unemployment to exceed 30%. The highest the unemployment rate hit in the Great Depression was 24.9%. Confusingly, he also said that he expects this high rate of unemployment to last one or two quarters and then we would bounce right back to normal.

Huh? I truly don’t know what to make of that statement. It seems highly improbable to immediately “bounce back to normal” when so many businesses are closing their doors.

On another note, once sacrosanct dividends are being cut or eliminated. Case in point, Ford just eliminated their dividend. It was only a week ago that I was doing research on this name as the yield was over 10%. Analysts said that with $26.8 Billion in cash on hand the dividend was secure. Now it is gone.

Most analysts expect the downturn to be short-lived. The crowd is usually wrong.

The market has been propped up by corporate share buy backs and dividend increases. Will they resume once the virus is gone? It is difficult to see that happening. In fact, they may not be allowed to do share buy backs if they take money in the corporate bail out.

The Federal Reserve’s latest steps to shore up the economy were drastic. It will buy an unlimited amount of Treasuries and mortgage securities via quantitative easing to battle an expected recession. The Fed also announced plans to support the flow of credit to businesses, governments and individual borrowers.

But for now, the coronavirus crisis continues to deepen, and the stock market is not responding to the medication.

As we look ahead, we are closely watching the rate of growth in new coronavirus cases. A slowing growth rate will be a relief for investors. In addition, the emergence of effective treatment protocols in the coming weeks and months will be the key to improving investor sentiment and hastening the stock market’s recovery. Nonetheless, for the time being investors should maintain social distancing from the coronavirus bear market. If you go shopping for stocks, you’re taking a risk. Unlike groceries, you don’t actually need to buy stocks every few days. So don’t rush to buy stocks like it’s the last 12-pack of 2-ply toilet paper on the shelf.

The old saying for March is, “In like a lion, out like a lamb.” My wife expressed to me the other day that it should be revised to, “In like a lion, out like an apocalypse”. We can only hope the apocalyptic overtones and grim economic data somehow reverse course very soon.

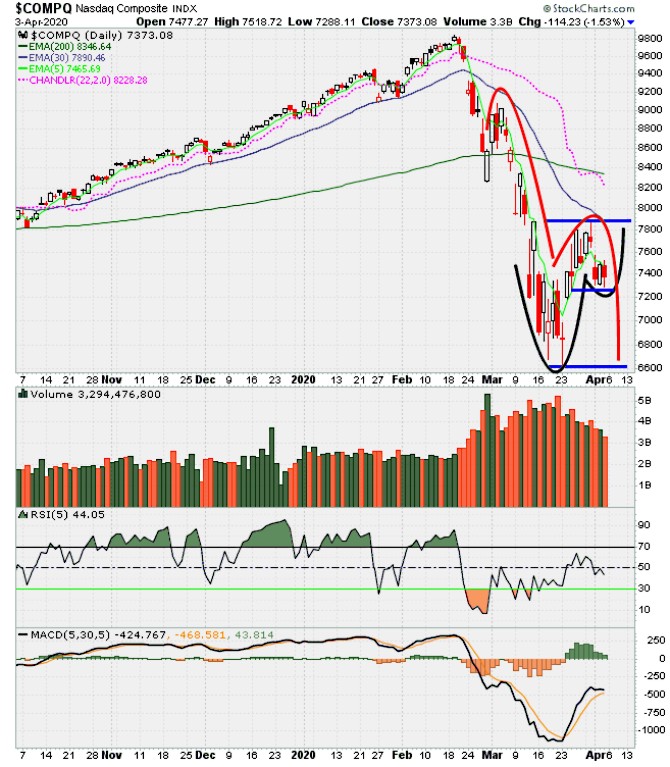

I have two charts to share. The first one is the Nasdaq Composite Index and second one is the New York Composite Index overlaid with the Unemployment Rate.

I have several lines drawn on this chart of the Nasdaq that I will explain. The upper blue line is a small area of resistance. If we can break above that level I could see the index run to about the 8200 level before a pause. That would be a gain of about 11% from here.

The two lower blue lines may offer support if we do go down. If the Nasdaq did not drop below the first one, that would be a positive sign. If it breaks it then it will test the lows set on March 23 where the lowest line is drawn. If that one breaks then I see a decline to roughly the 6000 level which is about 18% lower.

The black and red curved lines are known as 1,2,3 or a,b,c patterns. They are basically confirming what the blue lines are showing.

This chart of the New York Composite Index is very worrisome. It shows twenty years of data for the index and the unemployment rate. The black solid line is the unemployment rate. As you can see, after periods of prolonged decline a break of that trend seems to precede very steep declines in the stock market. We see this in 2000 and in early 2007. The data released on Friday shows a break of the current trend. Hopefully history does not repeat or even rhyme this time around.

I believe we will actually need to see true progress on the fight against the virus before the market can start to lead the way up again. Tonight as I write this commentary stock market futures are surging as there is a small glimmer of hope on the horizon. Coronavirus cases are still soaring but daily increases are slowing in some countries and New York. Dow Jones futures are up 3%, S&P futures are up 3.2% and Nasdaq 100 futures are up 3.7%. While this may not translate to stock market action in the morning it is still an encouraging sign.

Stay safe and healthy. Call me with any questions.